The possibility of challenging the provisions of a Will have now been available in New South Wales for 100 years!

In Roman times persons could bring a querela inofficiosi testament – complaining of “an undutiful and irresponsible Will”, where close relatives of the deceased, although expressly disinherited, could challenge the Will.

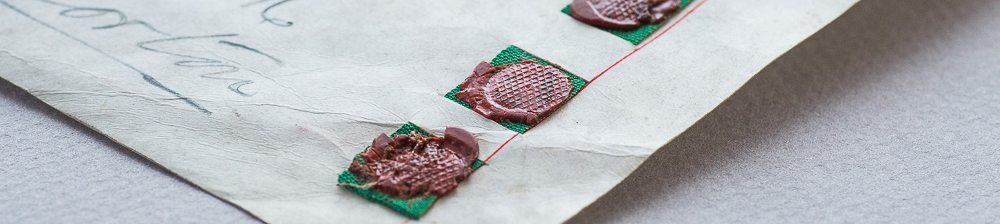

The relevant New South Wales legislation received Royal assent on 18th September 1916. However, the centenary of the legislation is celebrated on 7th October 2015, because of the notorious actions of a John Norton.

Norton, once a member of the New South Wales Legislative Assembly, left his entire Estate to his daughter, to the exclusion of his widow and son. The Parliament decided to make the legislation retrospective, so that it commenced before Norton’s death and allowed his widow, Aida Norton, and their son, to bring their family provision claim against the Estate.[1]

Today the current legislation (Succession Act 2006 (NSW)) specifies the persons who have standing (jurisdiction) to challenge the terms of a Will (called “eligible persons”) and then each eligible person, as an applicant, must establish his or her entitlement.

An eligible person is:

(a) a person who was the wife or husband of the deceased person at the time of the deceased person’s death,

(b) a person with whom the deceased person was living in a de facto relationship at the time of the deceased person’s death,

(c) a child of the deceased person,

(d) a former wife or husband of the deceased person,

(e) a person:

(i) who was, at any particular time, wholly or partly dependent on the deceased person, and

(ii) who is a grandchild of the deceased person or was, at that particular time or at any other time, a member of the household of which the deceased person was a member,

(f) a person with whom the deceased person was living in a close personal relationship at the time of the deceased person’s death.

In assessing a claim made by an applicant, the Court will consider

(a) any family or other relationship between the applicant and the deceased person, including the nature and duration of the relationship;

(b) the nature and extent of any obligations or responsibilities owed by the deceased person to the applicant…;

(c) the nature and extent of the deceased person’s estate and of any liabilities..;

(d) the financial resources (including earning capacity) and financial needs, both present and future, of the applicant, of any other person in respect of whom an application has been made for a family provision order or of any beneficiary of the deceased person’s estate;

(e) if the applicant is cohabiting with another person – the financial circumstances of the other person;

(f) any physical, intellectual or mental disability of the applicant, any other relevant person..;

(g) the age of the applicant when the application is being considered;

(h) any contribution (whether financial or otherwise) by the applicant to the acquisition, conservation and improvement of the estate of the deceased person or to the welfare of the deceased person or the deceased person’s family…

(i) any provision made for the applicant by the deceased person, either during the deceased person’s lifetime or made from the deceased person’s estate;

(j) any evidence of the testamentary intentions of the deceased person, including evidence of statements made by the deceased person;

(k) whether the applicant was being maintained, either wholly or partly, by the deceased person before the deceased person’s death and, if the Court considers it relevant, the extent to which and the basis on which the deceased person did so;

(l) whether any other person is liable to support the applicant;

(m) the character and conduct of the applicant before and after the date of the death of the deceased person;

(n) the conduct of any other person before and after the date of the death of the deceased person;

(o) any relevant Aboriginal or Torres Strait Islander customary law; and

(p) any other matter the Court considers relevant, including matters in existence at the time of the deceased person’s death or at the time the application is being considered.

[1] This material Courtesy of Darryl Browne-Law Society Journal September 2015

If you would like advice about a challenge to a Will, please contact our Wills Dispute Lawyers on 9232 8033.